It is that time again where you need to tally up the value of the gifts, motor vehicle benefits and entertainment that have been provided to staff and their associates from 1st April 2023 until 31st March 2024.

You may not need to lodge an FBT return but if you have any of the expenses noted below, you MUST have appropriate paperwork in place to explain why no FBT is payable. The ATO is becoming increasingly viligant in this space. Appropriate documentation is critical!

So your business owns vehicles. You need to consider FBT. The easiest approach is to ensure that a motor vehicle declaration is completed for each vehicle. On the motor vehicle declaration (click here), the driver/employee needs to write down the odometer reading at 31st March 2024, complete all other details and sign the declaration.

Each vehicle requires a separate declaration. This includes vehicles sold during the FBT year (1st April 2023 to 31st March 2024).

An FBT exemption exists for selected EVs and hybrid vehicles. A motor vehicle declaration is still required for these vehicles. Although the vehicles may be exempt from FBT, the provision of the benefit remains a Reportable Fringe Benefit and needs to be included on the employee’s annual payment summary.

If the vehicle is a commercial vehicle, such as ute or a van and the private usage is for travel between home to work and other minor and infrequent use, then the lower section of the declaration must also be completed and signed. Minor and infrequent use is identified by the ATO as:

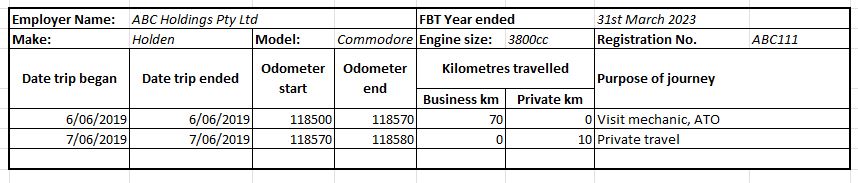

A valid logbook can be an eletronic version or a paper version. Regardless of which one you choose, it must record ALL of the following details:

Private travel is not required to be shown, but you may include it in your records to help with calculations.

Note that not all electronic logbooks meet the ATO documentation requirements.

The logbook must have been completed within the last five years and be representative of your current business/private travel arrangements.

Entertainment may include meals provided to employees, Friday night drinks and/or tickets to a sporting or other event. It may also include accommodation, golf and gym memberships, the provision of gifts etc. Each of these need to be considered and recorded correctly as entertainment (and no GST claimed) in your files.

Please advise us if you have any entertainment to be reviewed.

From time to time, you may provide gifts to your staff such as gift cards, movie vouchers or flowers for example. Where the value of the gift is less than $300 (GST incl) and the gift is infrequent, then it will generally be FBT exempt.

If your business has provided any of these, then please contact us to discuss further:

Debt Waiver Fringe Benefit: The waiving or forgiving of an employee’s debt to the employer.

Loan Fringe Benefit: A loan to an employee at less than a commercial rate of interest.

Expense Payment Fringe Benefit: Arises in either of two ways:

Housing Fringe Benefit: An employee is provided with the right to use a unit of accommodation and that unit of accommodation is the usual place of residence of the employee.

Property Fringe Benefit: Arises when an employee is provided with property (i.e. goods), free or at a discount, by an employer.

Residual Fringe Benefits: Any fringe benefit provided to an employee that does not fall within one of the above fringe benefits categories.